Exactly How Much Is Car Insurance Policy For a 17 Year Old Female? The majority of every kind of insurance sets their prices based off of information. car.

If a particular risk is less, after that the rates for that insurance coverage will be much less. When it pertains to 17 years of age females, the information shows that they are better vehicle drivers than 17 years of age men. Ladies have a tendency to obtain in less accidents as well as often tend to get less tickets. automobile.

Just How Much Is Insurance policy For a 17 Year Old Male? Male motorists, specifically young Click here! male chauffeurs, often tend to have greater prices for vehicle insurance coverage.

automobile cars insurance cheap car

automobile cars insurance cheap car

They can in some cases have great prices for 16 year olds, however they can additionally sometimes have poor rates for automobile insurance policy. Somebody who can look at lots of different business and also find the finest rate for your 16 year old.

No one intends to pay more money on car insurance coverage for their young adult than they have to! Do I Need to Include My Young Adult To My Insurance coverage? Yes, you must add all drivers of your automobiles to your car insurance plan. There is a negative report available where a great deal of agents are specifying that you do not need to add young motorists to your car insurance coverage.

This is completely false as well as these agents are establishing these individuals to have a horrible case experience where points are covered (insurance companies). Permissive use is for those individuals that would certainly drive your vehicle that do NOT reside in your residence and do not drive your car on a normal basis (insurance).

The 2-Minute Rule for How Much Will It Cost To Add My Teenager To My North Carolina ...

/calculating-premium.asp_sketch_revised-a342201375164378925271cdad1f1929.png) cars vehicle insurance cheap insurance cars

cars vehicle insurance cheap insurance cars

In a lot of cases, if an adolescent chauffeur accidents your vehicle as well as they are not provided on your policy as a chauffeur after that there would not be insurance coverage! Should My Teen Get Their Own Insurance Coverage Plan? No, your teen driver must not get their own insurance coverage. cheaper car insurance. They should be insured under your policy.

Not just is it much more cost effective to add your young adult to your automobile insurance however it also ensures you have the appropriate insurance coverage - vans. Obtaining your young adult their very own vehicle insurance plan while they are residing in your house produces all type of coverage concerns that may affect you at the time of an insurance claim.

Some firms want certain types of policies but do not desire other kinds of plans. cheap insurance. So some insurer will certainly have actually great pricing for teen motorists, due to the fact that they want that kind of organization whereas other vehicle insurance business will certainly have truly high rates on teen motorists since that sort of plan is not what they want (vehicle).

To check rates with an independent representative, visit this site - cheaper car insurance.

vans auto insurance car insurance money

vans auto insurance car insurance money

And that rate is simply for one cars and truck; if moms and dads determine to acquire an automobile for their kid to drive, the rate would likely be greater. cheap car insurance. While 16-year-olds are among one of the most pricey ages to insure, Bankrate's study has revealed manner ins which you might be able to locate more affordable insurance coverage for teens (laws).

Exactly how much is auto insurance coverage for a 16-year-old? The average cost boost to add a 16-year-old to their parent's policy is $2,531 annually. This cost remains in addition to the costs that parents are currently paying for 2 vehicle drivers and one vehicle. The additional cost does not consist of buying a car for your 16-year-old to drive, and it does not factor in any type of tickets or crashes that your child may incur behind the wheel.

Some Ideas on Best Cheap Car Insurance For Teens Of May 2022 - Forbes You Need To Know

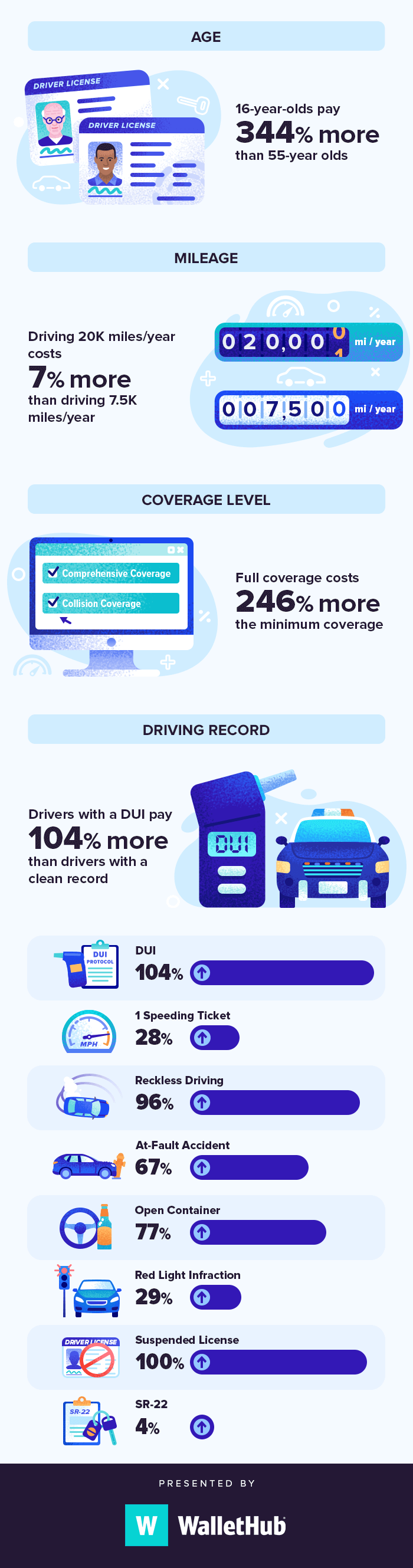

Including an unskilled driver to a car insurance coverage can trigger your yearly costs to enhance substantially. This is since auto insurance rates are figured out based upon danger. Young motorists, with their lack of experience when driving, are statistically a few of the riskiest chauffeurs to insure. Teenager motorists are more likely to obtain into accidents than any various other age, according to the Centers for Illness Control.

This, incorporated with the lack of experience of young motorists, makes teen men specifically pricey to guarantee. These ordinary rate increases are for young women and also men with no speeding tickets or mishaps, which would certainly trigger costs to enhance also extra.

The table below stands for the difference between the average annual costs for 16-year-old men and ladies as well as the overall typical rise you can expect to pay in each state. The rates represent just how much it sets you back to include a teen to their parents' policy. Some states, like Michigan and also North Carolina, do not use gender as a ranking factor.

USAAUSAA could be a great option for military members, professionals or prompt relative (insurance companies). The insurance firm includes low average prices and also outstanding customer support ratings from J.D. Power, although USAA is disqualified for main ranking due to its eligibility limitations - affordable auto insurance. Those insuring a teen driver could lower expenses with the vehicle driver training and also good student discounts.

suvs auto credit insurance

suvs auto credit insurance

And also if your teen decides to stay insured with USAA when they establish their own policy, they could earn a household discount rate or size of membership discount rate. Auto-Owners, Auto-Owners is not offered across the country, yet if you stay in one of the 26 states where protection is available, you may intend to obtain a quote.