auto insurance low cost vehicle insurance accident

auto insurance low cost vehicle insurance accident

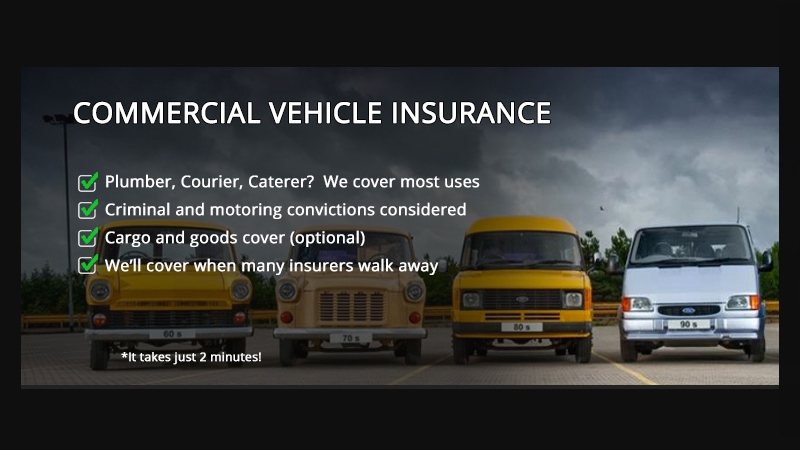

Industrial car insurance coverage is needed to cover the vehicles, vehicles, as well as vans utilized in performing your organization. Large fleets, along with small companies, need to be effectively covered by an industrial car insurance coverage. What is industrial car insurance policy? Industrial car insurance is a policy of physical damages and liability protections for amounts, scenarios, and usage not covered by a personal vehicle insurance plan.

What are the insurance coverages in a commercial automobile plan? spends for bodily injury or death arising from an accident for which you are at fault and for the most part gives you with a lawful protection. cheap auto insurance. gives you with defense if your car accidently harms one more individual's building and for the most part offers you with a legal defense.

A combined solitary restrictions plan has the same dollar amount of insurance coverage per covered incident whether bodily injury or building damage, one person or several - insurance affordable. normally spends for the medical costs of the driver as well as guests in your vehicle sustained as an outcome of a protected mishap despite fault.

We can also give proof of your liability restrictions for your work proposals as well as contracts as required. Is my trailer automatically covered by industrial vehicle insurance policy? That depends on the dimension of the trailer. It's instantly covered for liability. You'll require to include it to your plan for full insurance coverage in instance of burglary or damages.

: Covers your workers if they're harmed while working. The above is indicated as basic details and as basic policy descriptions to aid you understand the different kinds of insurance coverages. These summaries do not refer to any certain contract of insurance as well as they do not modify any type of definitions, exclusions or any various other provision specifically stated in any kind of contracts of insurance policy.

Getting The Commercial Auto Insurance: Coverage & Quotes - Advisorsmith To Work

cheaper car insurance vehicle insurance cheaper auto insurance cheaper car insurance

cheaper car insurance vehicle insurance cheaper auto insurance cheaper car insurance

Crashes including uninsured motorists, About one in eight motorists in the United States are without insurance, according to the Insurance Policy Research Council [PDF]. When they create accidents, they could not have the ability to spend for damages. Your plan's uninsured driver coverage sees to it your business does not have to pay for the resulting clinical expenses or vehicle fixings.

If you're thinking about auto insurance coverage for your service, it is necessary to recognize the basic aspects of a commercial car plan. The more you recognize, the less complicated it is to compare coverage as well as make an educated selection - cheap insurance. Business vehicle insurance policy meaning Commercial car insurance policy supplies a range of insurance coverages for cars and trucks, vehicles, vans and also various other lorries used by your business.

This could include being shut out of your cars and truck, dead batteries and also level tires New vehicle substitute price protection Changes your brand-new automobile insurance affordable under a total loss with a brand-new or comparable vehicle. Offers gap insurance coverage for any quantity you might owe that's above your vehicle's real cash money value Worked with car physical damages with loss of usage protection Covers extensive as well as collision damages to a rented or rented automobile, as well as any other contractual commitments to the leasing or rental company Car finance or lease insurance coverage Covers the difference between the unsettled amount on the lending or lease as well as the actual cash money value of the lorry, if your automobile is a total loss after a crash Expanded towing Gives towing insurance coverage beyond what's covered by your standard business auto policy.

laws insured car liability car insured

laws insured car liability car insured

Trick Takeaways You might require a business car insurance coverage policy to cover your cars and truck or vehicle if you use it for work, also if you just utilize it for company part of the moment. Industrial car insurance policy covers your cars and truck or vehicle and can be reached cover your staff members, also when they're driving their own automobiles - vehicle.

Nevertheless, these plans won't cover damages to your very own vehicle if you don't have a commercial plan with comprehensive and also collision security. What does industrial car insurance policy price? Like routine auto insurance, the cost of insurance coverage for industrial lorries depends on an array of aspects, consisting of the age of you or your vehicle drivers, accident background, as well as location.

Commercial Auto Insurance : Insurance For Businesses - Truths

Usually, it's a lot more expensive to get commercial auto insurance coverage than it is to guarantee a personal automobile.

You would certainly receive a reimbursement on the occasion that you altered to business vehicle insurance coverage in the middle of your policy, as long as your new price isn't greater than your old price - suvs. Can you obtain one-day organization insurance for a vehicle? Insurance coverage comes in six-month or 12-month terms.

Your insurance agreement is consisted of just in your plan, not in this site. cheapest car insurance. Your insurance coverage security might vary from the coverages explained right here, depending on the basic protections included in your plan and the optional coverages you acquisition.

* Protection may not be available in all locations (cheapest auto insurance).

Commercial vehicle insurance coverage, which is often referred to as fleet insurance coverage, covers usage as well as lorry kinds that an individual plan will not cover, so they are created as well as ranked in different ways (cheap car). According to Investopedia, a regular commercial policy includes the following sorts of protection: This coverage spends for medical care if the various other motorist is injured in an accident that you're at mistake for.

8 Simple Techniques For Business Vehicle Insurance - Iii

If your vehicle accidentally harms someone else's vehicle, this protection will certainly spend for repair work. If your policy consists of a consolidated solitary limit, that suggests your plan will cover the same amount of expenses for bodily injury as it provides for building damage. This protection pays for medical care for you and any passengers in your car, regardless of who is at mistake.

Notes, business owners can include extra kinds of coverage to their industrial automobile insurance coverage plan. These include: If you require aid due to the fact that you're locked out of your automobile, have a flat tire, or your vehicle's battery is dead, this coverage will cover the costs.

auto insurance cheapest automobile insured car

auto insurance cheapest automobile insured car

If you lease or lease lorries for business use, this protection will certainly spend for required repair services and also cover any obligations to the leasing firm. If you still owe money on your vehicle or the car is under a lease, this protection will certainly pay the difference between the unsettled amount and real cash value after a failure.

If you have to rent a lorry after yours is damaged in an accident, this insurance coverage will pay for it (cars). Personal Auto Insurance Policy vs. Business Vehicle Insurance, One of the most significant distinction in between an individual auto insurance coverage as well as a commercial automobile insurance policy is that the individual plan covers the cars and truck you have for personal use.

Policygenius points out that independent chauffeurs commonly make use of the exact same automobile for individual and service functions. If you're self-employed and also have an accident while using your vehicle for job, your individual policy will not cover the damages. You require a separate commercial plan to cover crashes that occur when you're on the task. cheap insurance.

The Ultimate Guide To Commercial Auto Insurance

The majority of Commercial automobile policies are "named chauffeur only" policies, meaning only those drivers detailed on the plan can operate a covered car. What are the protections? spends for physical injury or fatality arising from an accident for which you are at fault and also gives you with a legal defense. offers you with protection if your car accidentally damages an additional persons residential property (cheap car insurance).

cheaper insurance company car insured cars

cheaper insurance company car insured cars

In some cases, is additionally consisted of. This is for situations in which the at-fault driver has inadequate insurance policy. pays for damages to or replacement of your cars and truck from burglary, vandalism, flood, fire, and various other covered hazards. spends for damage to your auto when it hits or is struck by an additional things.

Typically, a commercial vehicle insurance coverage does not cover individual usage of a vehicle. To drive a job automobile for personal factors, a personal policy for that lorry would be required, or specific language requires to be included in the business policy to cover individual use.

Vehicle responsibility covers the damages to others' residential property that your auto may cause, as well as injury to other individuals. If you are included in an accident, our collision coverage will certainly pay to fix the damage to your vehicle, also if it is your fault.

There is also physical damage protection for other damage to your automobile. It is called thorough protection and it actually covers a great deal. Damages from fire, flood, criminal damage, and also theft are examples of what would be covered. If any individual in your auto is harmed in a mishap, we will pay clinical expenditures they incur.

6 Easy Facts About Commercial Auto - The Hanover Insurance Group Described

This protection pays for clinical expenses. In some states, shed income and also various other costs may be covered. Protects you if you remain in a mishap triggered by a without insurance chauffeur or a chauffeur who doesn't have enough insurance. We pay for costs as well as lost earnings. Acuity is devoted to giving the best possible defense to our valued clients.

In the occasion of a loss, this recommendation provides $10,000 for lost revenue or to get you when driving with a replacement automobile and also $3,000 for damages to audio, visual, or electronic equipment - vehicle. Lots of exclusive guest lorries are leased today, and also this recommendation spends for the lease or lending "void" that might arise when a lorry remains in an accident and the car is not worth as high as is owed.

This protection is available for private passenger vehicles purchased brand-new by the guaranteed that are guaranteed for detailed and also crash protection within 90 days of delivery - cheap insurance. We will pay up to the limit displayed in the statements for towing and labor expenses incurred each time a covered car is handicapped.

The coverage restricts you select influence the premium, the higher the insurance coverage amount, the higher your costs. If you're utilizing your automobile to perform organization, you may wish to consider a greater responsibility limitation to ensure that insurance coverage shields both your organization as well as individual assets if you are filed a claim against as a result of a crash.

This means that local business owners don't need to stress over spending for a broken job automobile expense; the job will certainly be covered under the insurance plan (subject to any type of relevant insurance deductible) (vehicle insurance). Criminal damage, dropped trees, and also also theft aren't constantly covered by individual insurance policy. However they are covered by the majority of industrial vehicle insurance coverage.

The smart Trick of Understanding Your Business Auto Insurance Policy - The ... That Nobody is Talking About

Clinical protection for commercial car insurance coverage likewise covers workers that are injured in a collision. This means that all those wounded at your firm can anticipate appropriate clinical attention to be covered under the insurance strategy - vans. Usually covered under personal car insurance too, uninsured vehicle driver insurance policy guarantees that your organization won't have to pay home or injury expenses if you're struck by one more motorist who doesn't have insurance.

Sometimes called thorough coverage, this option covers damage to your auto not triggered by an accident. It deals with issues like fire, theft, criminal damage, glass breakage, weather-related damage, as well as deer that come out of nowhere.

Service Automobile Responsibility Insurance Coverage is for companies that own and also run cars. This insurance coverage helps firms cover the expenses of fixing or changing business vehicles within the borders of the insurance policy. Every company that utilizes cars to negotiate service demands Business Automobile Insurance. Companies utilizing their personal vehicles for business-related objectives may discover that their personal insurance policy does not cover business-related threats (cheapest car insurance).

Depending on the protection chosen, this insurance covers lorries the service possesses, agreements with, as well as leases. It also assists cover hurt workers must an accident occur - vans.